open-end credit meaning and example

The acquisition of a closed-end credit is a solid indicator of the borrowers good credit rating. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit.

An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid.

. In this article well see the meaning of an open-end loan with an example. Open-End Credit Definition and Example Open-End Credit Meaning Stock Market Terms Related Terms Means. Closed-end credit usually has a lower interest rate than open-end credit.

Open-end credit refers to any type of loan where you can make repeated withdrawals and repaymentsExamples include credit cards home equity loans personal lines of credit and overdraft protection on checking accounts. 1 Examples of an Open-End Loan. Events that impact m arkets s tocks IPOs c ommodities f orex from regional to international Weve got it all covered.

A credit card is another great example of an open end loan this time it can be either secured or an open-end unsecured loan. This type of Consumer Credit is frequently used in conjunction with bank and department store credit cards. A type of revolving account that permits an individual to pay on a monthly basis only a portion of the total amount due.

11 Line of Credit. Covid-19 Stock Market Commodities. Closed-end credit is a loan or credit agreement signed by a lender and a borrower that includes information regarding the amount borrowed interest rates and charges and monthly payments payable depending on the borrowers credit rating.

US AUS USA UK NZ CA. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed.

It most frequently covers a series of transactions in which case. An open-end loan is a revolving line of credit issued by a lender or financial institution. Line of credit denotes a limit of credit extended by a bank to a customer who can avail himself or herself of its full extent in dealing with the bank but cannot exceed this limit.

Open-end credit means credit ex- tended under a plan in which a creditor may permit an applicant to make pur- chases or obtain loans from time to time directly from the creditor or indi- rectly by use of a credit card check or other device. Also called bank line credit line. The maximum borrowing power granted to a person from a financial institution.

An auto loan is an example of this. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed. If the credit card agreement does not require that you pay any collateral to get pre-approved for your credit limit it means that you have an open ended unsecured loan.

However interest is charged on the entire principal amount. However by establishing an open-end credit account with a limit of at least 500 the consumer would save the additional 159 annually in premiums assuming no transaction costs to opening the account would only need to exercise the credit option in the event of a loss and could extend the repayment over three years or more. Lines of credit are often secured which can mean that they have better interest rates than unsecured open-end.

485 42 votes. Though you pay interest on only the amount you use the interest rates tend to be higher as there is. It is available in two varieties each with unique characteristics that can benefit the borrower.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)

Line Of Credit Loc Definition Types And Examples

What Is A Credit Utilization Rate Experian

Understanding Different Types Of Credit Nextadvisor With Time

How To Use A Credit Card Best Practices Explained Valuepenguin

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

How To Order Movie Credits Guide To Opening And End Credits 2022 Masterclass

What Is A Closing Date On A Credit Card

Sales Journal Entry Cash And Credit Entries For Both Goods And Services

How To Use A Credit Card Best Practices Explained Valuepenguin

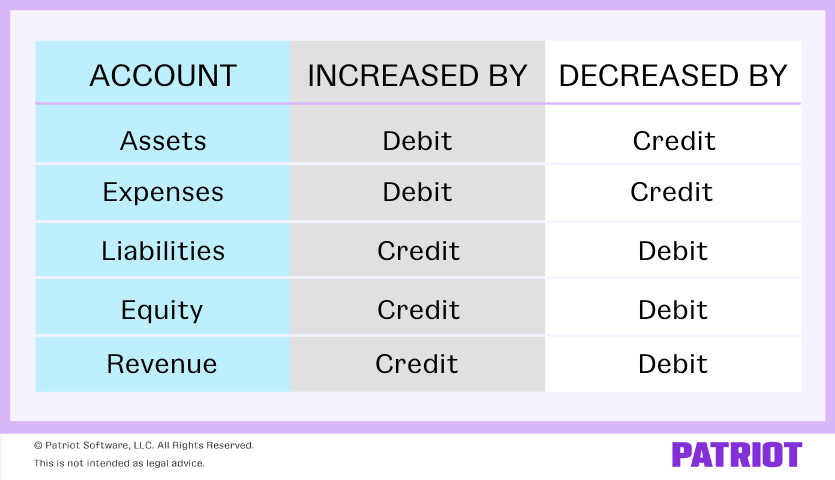

3 Golden Rules Of Accounting Rules To Follow Examples More

/letter-of-credit-474454659-ac5d6f45ce244478af87f92f1392884c.jpg)

Standby Letter Of Credit Sloc Definition

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/bank_176952073-5bfc2e2ac9e77c0051804798.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

/NAV_color_v1-554baefc87ca49f7a6f7de457cb386fb.png)

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)